-

Solution overview

Develop the technical skills that Fortune 500 enterprises and the public sector want.

-

U.S. Department of State (Cyber Advance for Women in MENA)

Build your skills and launch your career in Cybersecurity.

-

USAID Jordan (Tech for Jobs)

Increase your data analytics capabilities with this free program.

Where Data Meets Business: The New Gold Standard in Financial and Operational Planning Every Company Should Know

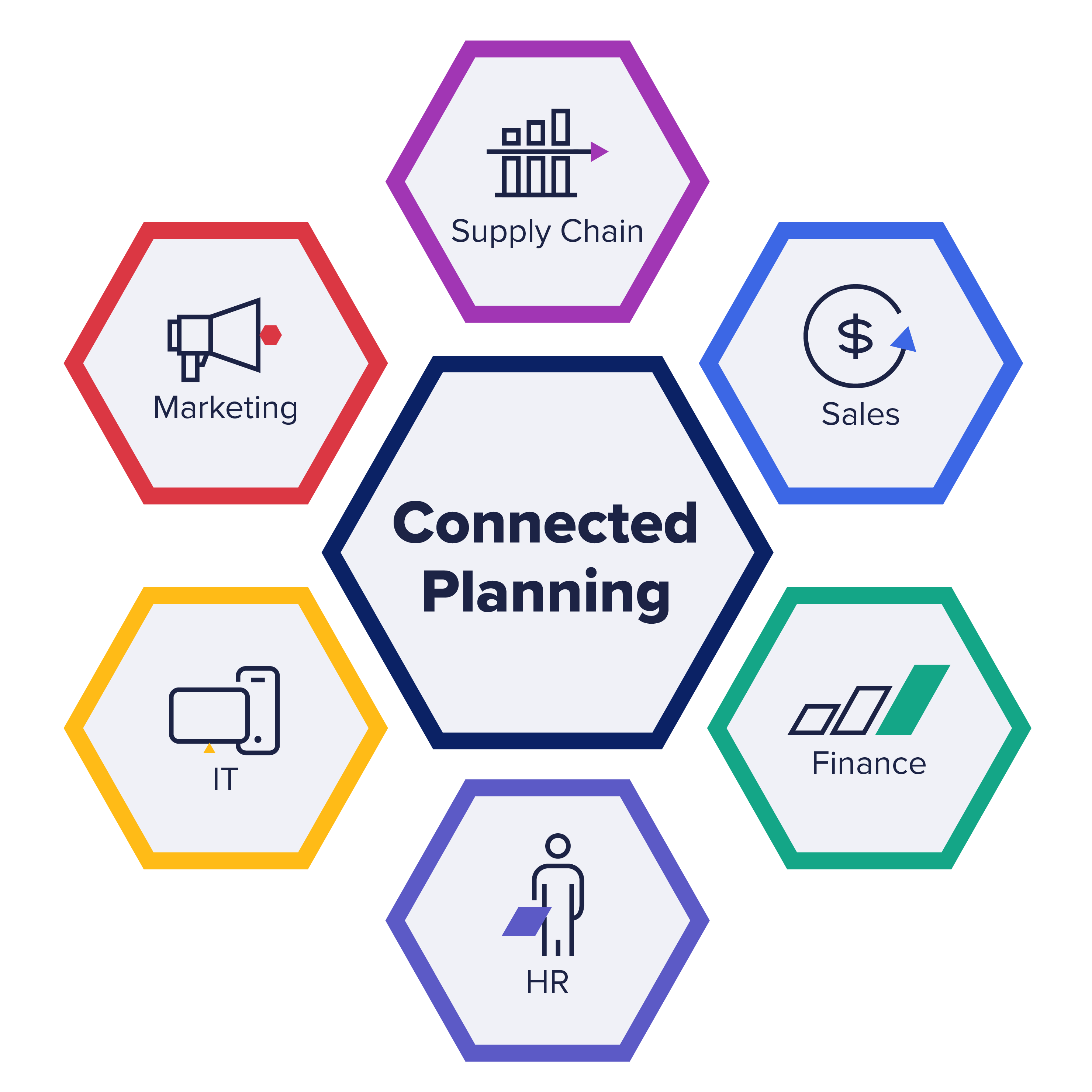

Think of all the areas today where businesses remain siloed with department-specific data: information on spreadsheets and in databases about sales projections, workforce plans, supplier inventory, customer research, and marketing promotions. Think about the processes a company goes through to do its planning—building revenue and expense forecasts, determining the right level of funding across departmental and economic scenarios, trying to align resources to achieve strategic targets, etc.

It is no wonder such planning is only performed annually, since cobbling together data across these silos is extremely tedious and requires cross-functional effort. By the time the data is gathered, it is already stale; and the value and accuracy of the projections is limited.

Now imagine a digitally-progressive business that connects all of these siloed forecasts and data streams into a shared and collaborative platform. A business that leverages planning as a differentiator to facilitate customer demand, headcount projections, and sales pipelines all being updated in real-time, leveraging macroeconomic forecasts. Such a business has all of its financial and operational data digitized and connected. Consider the impact this digital platform has on the company’s ability to plan, order the right parts, staff to the right levels, and pivot intelligently when adverse scenarios hit.

This is the power available to modern and visionary leadership. A platform like Anaplan enables companies to reach this state of digitization and connection across data, people and plans.

We spoke to Sara Baxter-Orr, Global Head of the CFO Practice at Anaplan, who describes the nimbleness required of organizations operating in today’s fast-paced environment. She notes organizations need to be in a position to run business scenarios in real-time, and trace the implications on operating metrics: “I used to tell my teams, headquarters isn’t ‘doing this to us’ - it’s the marketplace that’s ‘doing it to us’!”

This ability to react in real-time to changes in market conditions was critical to one of Anaplan’s customers, Onduline, who required an agile platform to quickly adjust plans and respond to disruptions and volatility in customer demand, sourcing, and pricing.

And they’re not the only customer benefiting from the capabilities of a connected planning platform. Del Monte leverages Anaplan to provide clear line of site and to pivot when unforseen events change both supply and demand, a critical need when planning for products that are highly perishable with a lengthy growing season.

CFOs and their finance teams are at the center of helping companies balance disruption and recovery, predict and protect revenue, optimize workforce, and manage supply chain risk. Finance teams need to build confidence and trust with the C-suite and board by providing wide-ranging forecasts, plans for multiple scenarios, and the impacts on business performance. At the same time, finance teams need to work closely with HR, sales, and supply chain teams to operationalize these plans, monitor results closely, and continuously update forecasts and plans to manage business performance.

What skills are required of modern financial planners? Baxter-Orr describes them as having a hybrid of “data science and MBA”, or data and business skills. They need accounting and compliance, domain expertise that traditional financial planners have, but also need expertise in data literacy - the ability to analyze data, model scenarios, and translate ideas into numbers, models and charts. However, most important is intellectual curiosity and the creativity to imagine a multitude of possibilities that could impact business, customers and the supply chains. Then, financial planners are able to get to work by forecasting scenarios, and where necessary, making assumptions that go into commercial planning.

The infrastructure skills to pull data from multiple data sources is less important to the modern financial planner than the analytical skills to develop and model scenarios. Ultimately, it is the financial modeler’s job to use knowledge of business drivers and data literacy to predict business impact across a range of scenarios so business leaders can make informed decisions.

A great example of the value to be gained from modeling drivers through multiple scenarios is Carter’s, which removed 6 days worth of inventory from its supply chain, saving over $25 million annually. These results were due to leveraging the Anaplan platform to better capture demand signals, provide visibility across the supply chain, and align to finance for achievement of operational targets.

Ultimately, to drive business insights and operational efficiencies across the organization, data literacy is as important as the platforms that connect the data. Moving forward, data fluency is a foundational requirement for professionals seeking to excel in the jobs of tomorrow, and it is a mission-critical need for organizations who want to remain competitive.

We're delighted that through our Data Science for All / Empowerment program, we've partnered with Anaplan to train Fellows from under-represented backgrounds on Anaplan's platform for data modeling skills. Anaplan's network of clients will benefit from a pipeline of trained, job-ready and diverse talent to hire from. Together with Anaplan, we are creating equal access to the jobs of tomorrow.

For more guidance on intelligent forecasting and agile planning, read Anaplan’s latest white paper here.

.png?width=207&height=108&name=Mega%20menu%20%E2%80%93%20Featured%20Image%20Template%20(1).png)